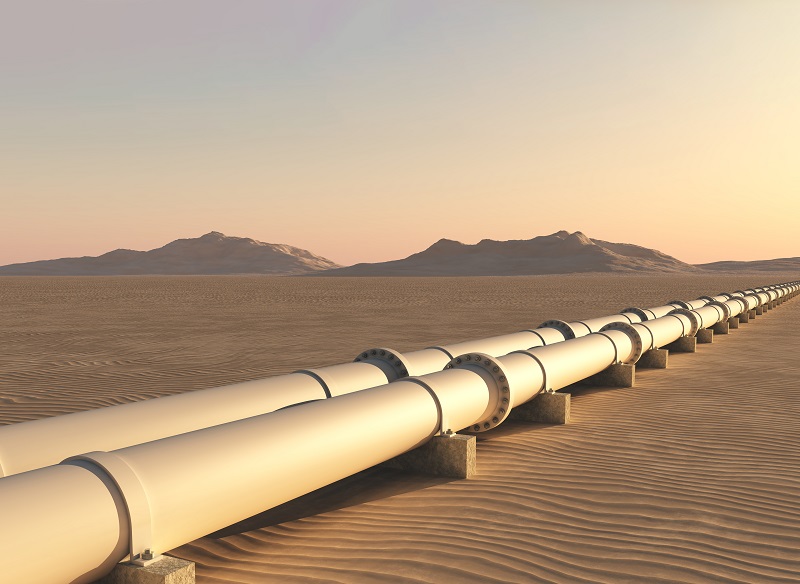

GIC Joins KKR, BlackRock and Abu Dhabi Pensions Fund in Landmark ADNOC Pipeline Infrastructure Investment Agreement

Combined investment by all investment parties totals almost $5 billion

Transaction underlines the quality of ADNOC’s pipeline assets and attractive opportunities in the UAE over the long term

This follow-on investment agreement will see GIC acquire a 6% stake in a newly formed entity, ADNOC Oil Pipelines LLC (‘ADNOC Oil Pipelines’), with BlackRock and KKR together holding 40%, ADRPBF 3% and ADNOC the remaining 51%. Sovereignty over the pipelines and management of pipeline operations remain with ADNOC. The transaction is expected to close before the end of 2019, subject to customary closing conditions and all regulatory approvals.

The innovative leasing investment structure has seen GIC and other top-tier global and domestic institutional investors deploy long-term capital into ADNOC’s key infrastructure assets.

Commenting on the transaction, Ahmed Jasim Al Zaabi, Group Director Finance and Investment at ADNOC said: “We are delighted that GIC, one of the world’s most renowned sovereign wealth funds and a leading long-term global investor, has joined KKR, BlackRock and the Abu Dhabi Pensions Fund in this pioneering investment in select ADNOC oil pipelines.

“With nearly $5 billion of total investment, the overall agreement is testimony to the global investment community’s positive view on the attractiveness of both the UAE’s long-term potential, as well as the quality of ADNOC’s substantial infrastructure asset base.”

Ang Eng Seng, Chief Investment Officer for Infrastructure at GIC, said: “We are pleased to establish our partnership with ADNOC, a leading operator with a strong track record and an innovative approach. As a global long-term investor, we are confident in the quality of ADNOC’s substantial oil pipeline network, which is a core element of Abu Dhabi’s energy ecosystem. We look forward to supporting ADNOC in the future growth of its oil pipeline business.”

Over the last two years, ADNOC has significantly expanded its strategic partnership and co-investment model and created new investment opportunities across all areas of its value chain, while at the same time, more proactively managing its portfolio of assets and capital.

.ashx?h=748&w=1000&hash=23B79F2DEDB1AEAC75968BDB7A78AB66)